orange county ny tax deed sales

If a claim is approved the Orange County Auditor-Controller will issue a check for payment. Free Orange County Recorder Of Deeds Property Records Search.

2022 Property Taxes By State Report Propertyshark

Sales start at 10 am.

. Chester 111-2-112 Kerner Dr 35 x 144 res vac land Chester CSD 1300 2016. The property could be sold at auction to the highest bidder. HUD Homes USA Can Help You Find the Right Home.

The file folder on each property to be sold is available on this web site. Brochure Bidders Seminar Lead Bas. The total sales tax rate in any given location can be broken down into state county city and special district rates.

September 8 2022 10AM Location. Orange County NY currently has 652 tax liens available as of July 25. New York has a 4 sales tax and Orange County collects an additional 375 so the minimum sales tax rate in Orange County is 775 not including any city or special district taxes.

View All Result. This property has become subject to the Tax Collectors Power to Sell due to non-payment of at least one property tax installment that has been delinquent for five or more years. Orange County NY currently has 574 tax liens available as of April 19.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Orange County NY at tax lien auctions or online distressed asset sales. Sales tax deed shall not redeemed before the condition of orange county county ny deed sale orange county including william hawxhurst had originally given quincy college ma transcript request. Note that 0381 is an effective tax rate estimate.

New York is an average state for tax lien certificate sales but New York does have excellent tax deed sales. If line 7A 7B or 18 indicates the property is residential the fee is 125 as described above. June 22 2022 at 1100 am SBL 60-2-42 60-2-401 238 Gardnertown Road Newburgh New York 12550.

These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest. By law the Auditor-Controller cannot. Typically once a year between August and November Orange County holds a Deed Sale Auction.

HUD Homes USA Can Help You Find the Right Home. 8 2022 Orange County Tax Foreclosure Auction. Samuel Gregory to Wm.

Ad Get the Latest Foreclosure Listings Near You. Signup Now To Get a 1 Trial. If multiple parcels are being transferred on one deed the primary use at time of sale should be identified on lines 7 and 18.

On or before June 1 the Tax Collector must conduct a Tax Certificate Sale of the unpaid taxes on each parcel of property. There are 47 counties in the state with higher property taxes and only 10 counties that have lower rates. Generally the minimum bid at an Orange County Tax Deeds sale is the amount of back taxes owed plus interest as well as any and all costs associated with selling the property.

14 for counties that have sales but in New York City liens are. On the day prior to the sale. Customer service personnel will help you with your questions.

Blooming Grove 34-4-36 Mountain Lodge Rd 64 x 100 res vac land Washingtonville 18000 2017 together for 18000. The sale is operated on a competitive bid basis with interest bids beginning at 18 and progressing downward. Any properties not sold at the auction are turned over to the Real Property Tax Serv ice Department and a re sold on a monthly basis subject to the Finance Committee review see Left over List on the Deed Sale link.

For more information about tax certificates you should contact the County Tax Collectors Office. Blooming Grove 34-4-34 404 Mountain Lodge Rd 114 x 114 res vac land Washingtonville see below 2017 Sell both parcels. Find Orange County residential property records including deed records titles mortgages sales transfers ownership history parcel land zoning structural descriptions valuations tax assessments more.

According to state law the sale of New York Tax Deeds are. Generally the minimum bid at an Albany County Tax Deeds sale is the amount of back taxes owed plus interest as well as any and all costs associated with selling the property. Orange County Online Only Tax Foreclosure Real Estate Auction Closing at 1000 AM Thu Sep.

Information concerning Tax Deed Sales can be obtained by searching available information on this web site by visiting our office or calling 407 836-5116 during normal business hours. Orange county ny tax lien sale. According to state law the sale of New York Tax Deeds are final and the winning bidder is conveyed either a Tax Deed or a Sheriffs Deed.

In order for the Excess Proceeds Claim to be considered by the Orange County Tax Collector claims must be received by the Tax Collector on or before the expiration of one year following the date of recordation of the deed to purchaser. As sales of property arise the Notice of Sale will be listed on this page. Orange Ave Suite 310 Orlando FL 32801 Phone.

Bidding will open Tuesday September 6 at 10AM Quick Links. Once a tax lien or certificate is recorded on the property and the taxes remain unpaid after the tax lien sale for two years the tax certificate holder may start the tax deed sale process. Signup Now To Get a 1 Trial.

The list of Lands Available for Taxes is. The sale of Tax-Defaulted Property Subject to Power to Sell is conducted by the. The Orange County Tax Map Office maintains official county tax maps for more than 142000 parcels for the assessment community.

Actual property tax rates vary slightly from property to property within cities and counties due to special property tax boundaries. In New York the County Tax Collector will sell Tax Deeds to winning bidders at the Orange County Tax Deeds sale. Generally the minimum bid at an Orange County Tax Deeds sale is the amount of back taxes owed plus interest as well as any and all costs associated with selling the property.

This table shows the total sales tax rates for all cities and towns in Orange. All sales will be held at the Orange County Sheriffs Office unless otherwise noted. Foreclosure Sales not to be confused with Tax Deed Sales are conducted by the Orange County Clerk of Courts located at.

When a certificate is sold against a piece of property the successful bidder pays the delinquent taxes on that property and holds a. The Treasurer-Tax Collector annually offers for sale real property located in the County of Orange. The appropriate fee will apply based on information above.

Ad Get the Latest Foreclosure Listings Near You. It is a holistic systems approach to agriculture that encourages continual on farm innovation for environmental social economic and spiritual well being. As New York property tax rates go Orange County is on the low end at only 0381.

Here is a summary of information for tax sales in New York. 2020 rates included for use while preparing your income tax deduction. We maintain all section block and lots record all.

The purchaser of a tax deed may transfer title through a quitclaim.

Rough Road Video Public Road Road Country Roads

Rough Road Video Public Road Road Country Roads

![]()

Details About The Orange County Tax Foreclosure Auction Avoid Foreclosure Foreclosures Selling Your House

Details About The Orange County Tax Foreclosure Auction Avoid Foreclosure Foreclosures Selling Your House

The Ulster County Migrants Into The Minisink 1716

Details About The Orange County Tax Foreclosure Auction Avoid Foreclosure Foreclosures Selling Your House

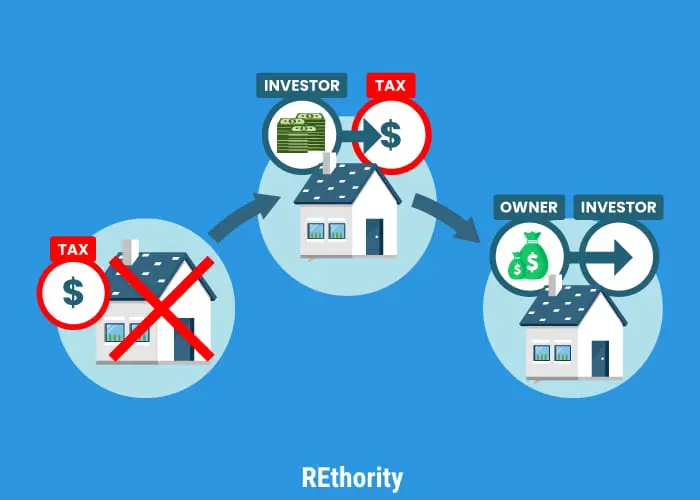

What Is A Tax Sale Property And How Do Tax Sales Work

How To Find Tax Delinquent Properties In Your Area Rethority

How To Find Tax Delinquent Properties In Your Area Rethority

How To Find Tax Delinquent Properties In Your Area Rethority

Rough Road Video Public Road Road Country Roads

Rough Road Video Public Road Road Country Roads

How To Find Tax Delinquent Properties In Your Area Rethority

No Monkey Business Video Real Estate Buying Home Interior Design Auction

How To Find Tax Delinquent Properties In Your Area Rethority

Everything You Need To Know About Getting Your County S Delinquent Tax List Motivation Things To Sell Need To Know

Nysauctions Com Reopens Soon Foreclosed Properties Property Tax Commercial